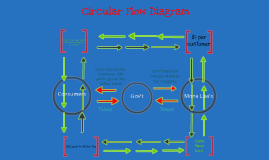

Circular Flow Diagram

Transcript: Circular-Flow Diagram The people that live under the same roof, share their wages, and make the world go round:) Markets for Goods and Services Foreign lending and purchases of stock Where the gov. and households can purchase goods and services they need from firms. Taxes Foreign borrowing and sales of stock THE WORLD! A COST TO EVERYONE Gary Gensler of the Commodity Futures Trading Commission says the current system “adds up to higher costs to all Americans.” The men share a common goal: to protect the interests of big banks in the vast market for derivatives, one of the most profitable — and controversial — fields in finance. They also share a common secret: The details of their meetings, even their identities, have been strictly confidential. Drawn from giants like JPMorgan Chase, Goldman Sachs and Morgan Stanley, the bankers form a powerful committee that helps oversee trading in derivatives, instruments which, like insurance, are used to hedge risk. In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks. The banks in this group, which is affiliated with a new derivatives clearinghouse, have fought to block other banks from entering the market, and they are also trying to thwart efforts to make full information on prices and fees freely available. Banks’ influence over this market, and over clearinghouses like the one this select group advises, has costly implications for businesses large and small, like Dan Singer’s home heating-oil company in Westchester County, north of New York City. This fall, many of Mr. Singer’s customers purchased fixed-rate plans to lock in winter heating oil at around $3 a gallon. While that price was above the prevailing $2.80 a gallon then, the contracts will protect homeowners if bitterly cold weather pushes the price higher. But Mr. Singer wonders if his company, Robison Oil, should be getting a better deal. He uses derivatives like swaps and options to create his fixed plans. But he has no idea how much lower his prices — and his customers’ prices — could be, he says, because banks don’t disclose fees associated with the derivatives. “At the end of the day, I don’t know if I got a fair price, or what they’re charging me,” Mr. Singer said. Derivatives shift risk from one party to another, and they offer many benefits, like enabling Mr. Singer to sell his fixed plans without having to bear all the risk that oil prices could suddenly rise. Derivatives are also big business on Wall Street. Banks collect many billions of dollars annually in undisclosed fees associated with these instruments — an amount that almost certainly would be lower if there were more competition and transparent prices. Just how much derivatives trading costs ordinary Americans is uncertain. The size and reach of this market has grown rapidly over the past two decades. Pension funds today use derivatives to hedge investments. States and cities use them to try to hold down borrowing costs. Airlines use them to secure steady fuel prices. Food companies use them to lock in prices of commodities like wheat or beef. The marketplace as it functions now “adds up to higher costs to all Americans,” said Gary Gensler, the chairman of the Commodity Futures Trading Commission, which regulates most derivatives. More oversight of the banks in this market is needed, he said. But big banks influence the rules governing derivatives through a variety of industry groups. The banks’ latest point of influence are clearinghouses like ICE Trust, which holds the monthly meetings with the nine bankers in New York. Under the Dodd-Frank financial overhaul, many derivatives will be traded via such clearinghouses. Mr. Gensler wants to lessen banks’ control over these new institutions. But Republican lawmakers, many of whom received large campaign contributions from bankers who want to influence how the derivatives rules are written, say they plan to push back against much of the coming reform. On Thursday, the commission canceled a vote over a proposal to make prices more transparent, raising speculation that Mr. Gensler did not have enough support from his fellow commissioners. The Department of Justice is looking into derivatives, too. The department’s antitrust unit is actively investigating “the possibility of anticompetitive practices in the credit derivatives clearing, trading and information services industries,” according to a department spokeswoman. Government transfers Financial Markets Investment spending Government purchases of goods and services Through the purchase and sale of stocks America borrows and lends money, and receives imports and sends exports to the rest of the world. Government Borrowing Households Private Savings FIRMS Government Its your job yo. Where you earn money for your household Imports Factor Markets Consumer spending Finacial markets are the baning system basically. Where people invest, save, and